Import historical data in MT5

Discussion of article "How to Post a Product in the Market"

Scripts: News VLine

Forex Spreads and the News (based on dailyfx article)

- Spreads are based off the Buy and Sell price of a currency pair.

- Spreads are variable and can change during news.

- Watch for normalization of spreads, shortly after economic events.

Financial markets have the ability to be drastically effected by

economic news releases. News events occur throughout the trading week,

as denoted by the economic calendar, and may increase market volatility

as well as increase the spreads you see on your favorite currency pairs.

It is imperative that new traders become familiar with what can happen during these events. So to better prepare you for upcoming news, we are going to review what happens to Forex spreads during volatile markets.

Spreads and the News

News is a notorious time of market uncertainty. These releases on the

economic calendar happen sporadically and depending if expectations are

met or not, can cause prices to fluctuate rapidly. Just like retail

traders, large liquidity providers do not know the outcome of news

events prior to their release! Because of this, they look to offset some

of their risk by widening spreads.

Above is an example of spreads during the January NFP employment number release. Notice how spreads on the Major Forex pairs widened. Even though this was a temporary event, until the market normalizes traders will have to endure wider costs of trading.

Dealing with the Spread

It is important to remember that spreads are variable, meaning they will

not always remain the same and will change as liquidity providers

change their pricing. Above we can see how quickly spreads normalize

after the news. In 5 minutes, the spreads on the EURUSD moved from 6.4

pips back to 1.4 pips. So where does that leave traders wanting to

execute orders around the news?

Traders should always consider the risk of trading volatile markets. One

of the options for trading news events is to immediately execute orders

at market in hopes that the market volatility covers the increased

spread cost. Or, traders can wait for markets to normalize and then take

advantage of added liquidity once market activity subsides.

Discussion of article "How to Prepare a Trading Account for Migration to Virtual Hosting"

Hello!

I just synchronized my account, and for my surprise, the Metatrader 4 VPS is picking the wrong access point! It should pick the London access point from my broker, just like my terminal did, which has less than 2ms ping.

But instead it is picking Europe access point, which is 63ms ping! It is stated in the Metatrader 4 VPS journal.

I stopped, synchronized again, cancelled the VPS, subscribed again, restarted, but it is still picking the worst access point, as written in its journal.

I double checked during the subscription process, and there it points only 2ms from my terminal current access point, but after initializing the VPS, it decides to pick another access point somehow...

How can I make this Metatrader 4 VPS pick the correct and lowest ping access point, just like my terminal?

Traders Joking

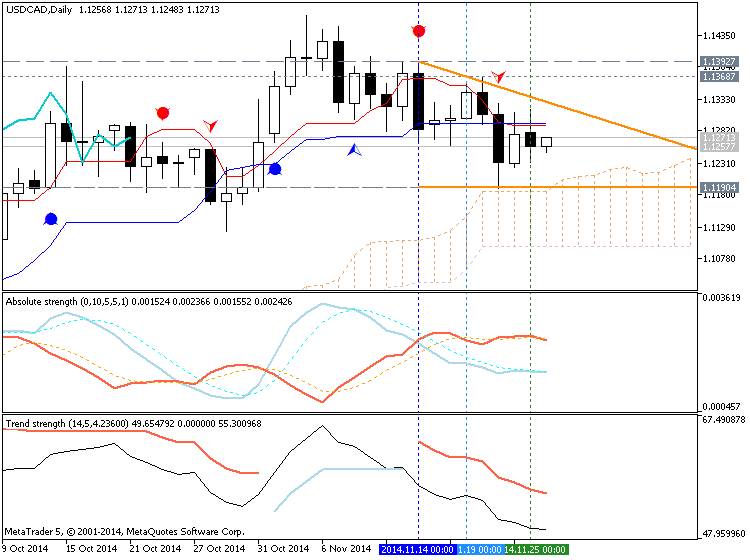

USDCAD Technical Analysis 2014, 23.11 - 30.11: Correction With Breakdown For Possible Reversal

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.26 10:07

Trading News Events: U.S. Durable Goods Orders (adapted from dailyfx article)

Another 0.6% contract in orders for U.S. Durable Goods may generate a

more meaningful rebound in EUR/USD as it dampens the growth and

inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

The threat of a slower recovery may further delay the Fed’s normalization cycle as Chair Janet Yellen remains in no rush to remove the zero-interest rate policy (ZIRP), and the dollar may face a larger correction over the near-term should interest rate expectations falter.

Nevertheless, the ongoing improvement in consumer confidence may

generate a better-than-expected print, and a rebound in demand for U.S.

Durable Goods may heighten the bullish sentiment surrounding the dollar

as the Fed is widely expected to raise the benchmark interest rate in

2015.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract 0.6% or Greater

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

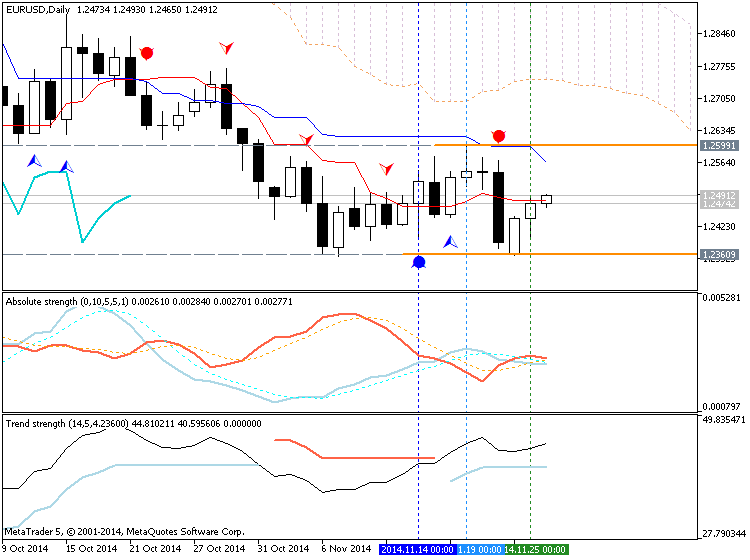

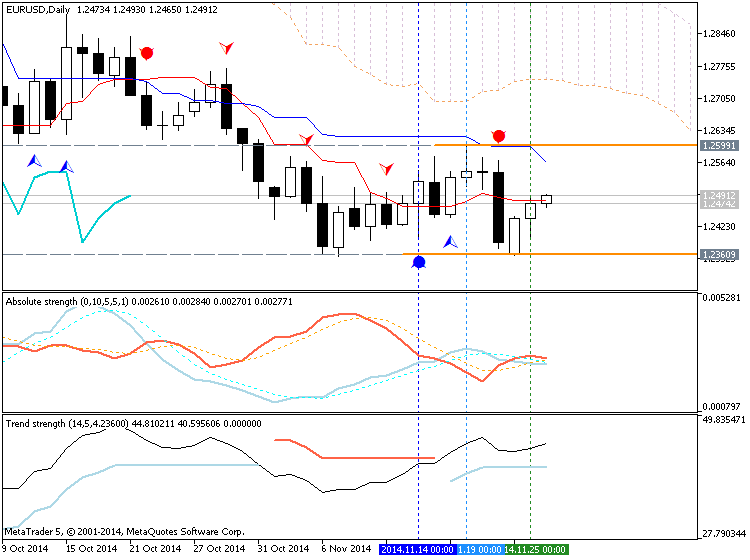

EUR/USD Daily Chart

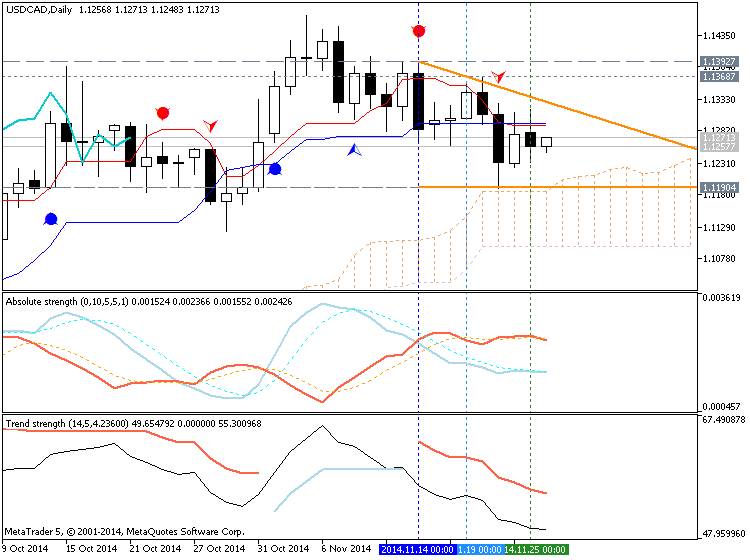

USD/CAD Daily Chart

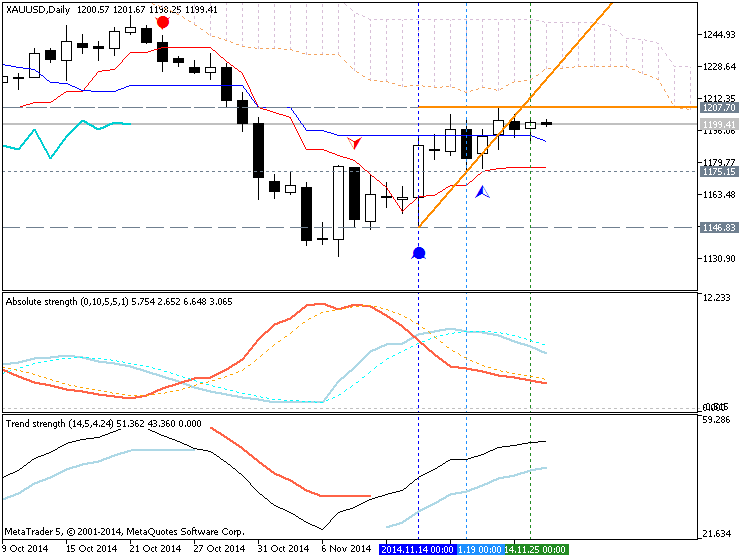

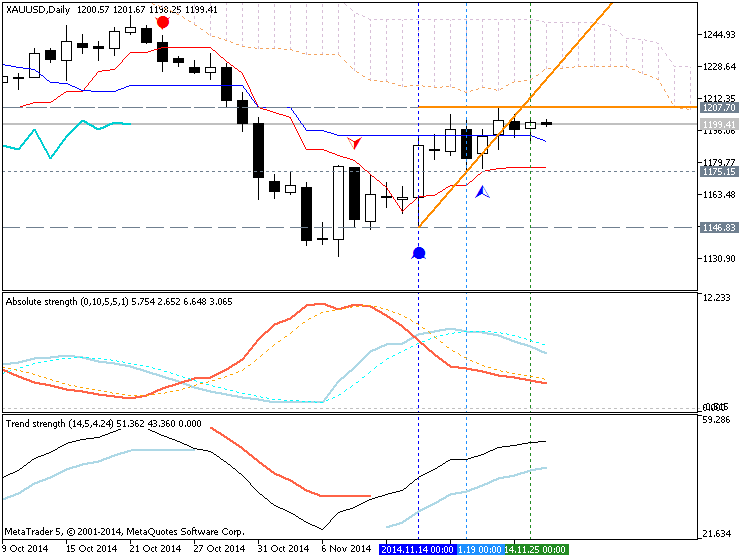

XAU/USD Daily Chart

- Will watch the November high (1.2599) as EUR/USD holds above the monthly low (1.2356).

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 |

10/28/2014 12:30 GMT | 0.5% | -1.3% | + 42 | + 27 |

September 2014 U.S. Durable Goods Orders

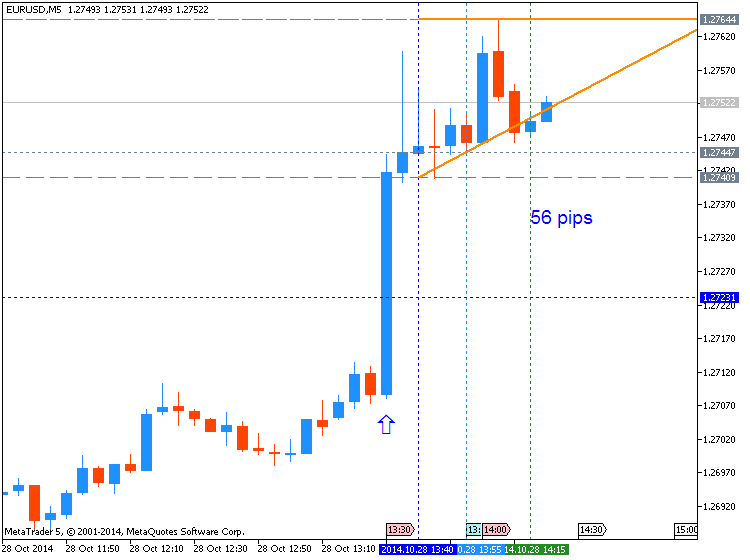

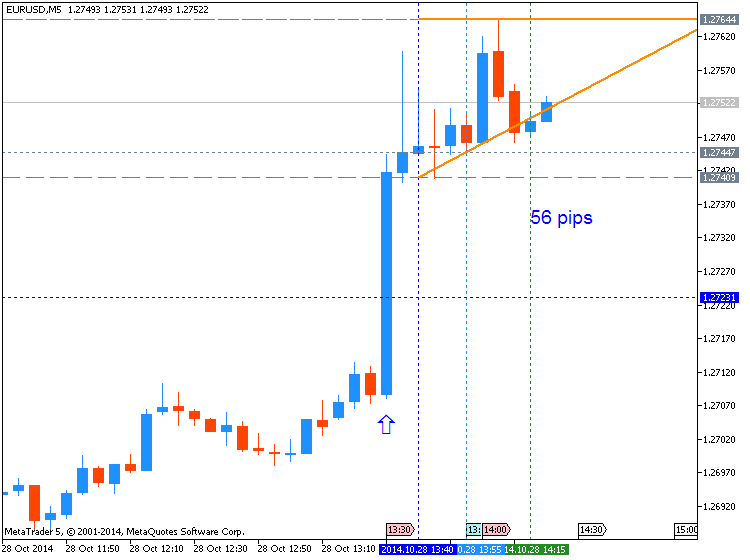

EURUSD M5: 56 pips price movement by USD - Durable Goods Orders news event:

Demand for U.S. Durable Goods slipped another 1.3% in September

following the record 18.3% contraction the month prior. Orders for

non-defense capital goods excluding aircraft, a proxy future business

investments, also fell 1.7% during the same period. The persistent

weakness in demand for large-ticket items may further dampen the outlook

for global growthamid the weakening outlook for Europe and China. The

greenback struggled to hold its ground following the worse-than-expected

print, with EUR/USD climbing above the 1.2750 handle, but there was

limited follow-through behind the market reaction as the pair closed at

1.2734.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

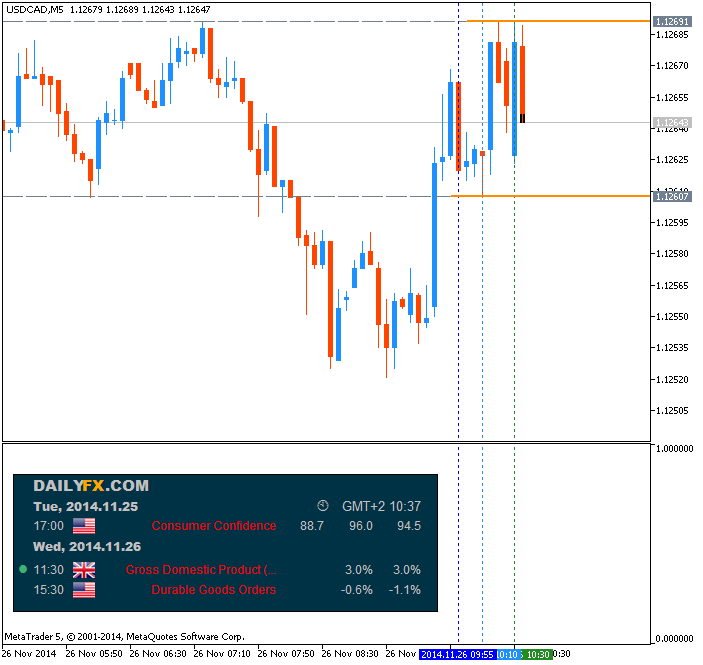

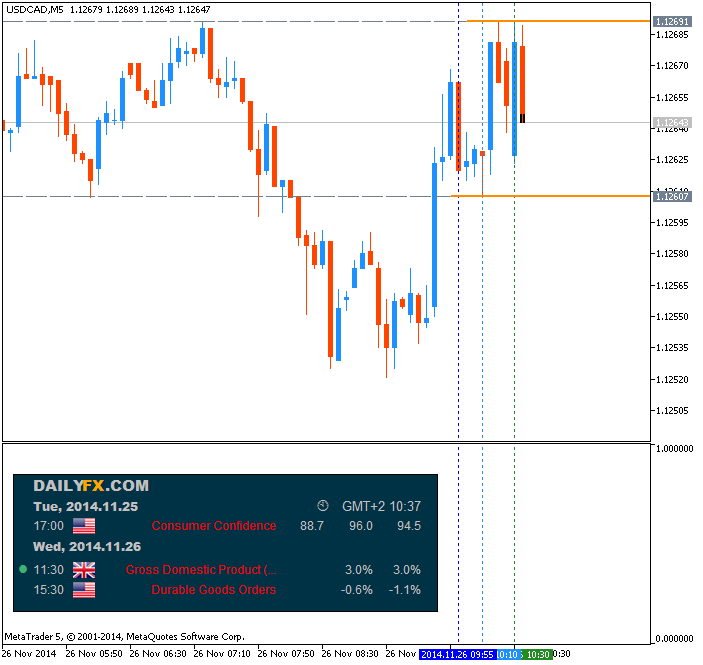

USDCAD M5: 11 pips price movement by USD - Durable Goods Orders news event

Market Condition Evaluation based on standard indicators in Metatrader 5

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.11.26 10:07

Trading News Events: U.S. Durable Goods Orders (adapted from dailyfx article)

Another 0.6% contract in orders for U.S. Durable Goods may generate a

more meaningful rebound in EUR/USD as it dampens the growth and

inflation outlook for the world’s largest economy.

What’s Expected:

Why Is This Event Important:

The threat of a slower recovery may further delay the Fed’s normalization cycle as Chair Janet Yellen remains in no rush to remove the zero-interest rate policy (ZIRP), and the dollar may face a larger correction over the near-term should interest rate expectations falter.

Nevertheless, the ongoing improvement in consumer confidence may

generate a better-than-expected print, and a rebound in demand for U.S.

Durable Goods may heighten the bullish sentiment surrounding the dollar

as the Fed is widely expected to raise the benchmark interest rate in

2015.

How To Trade This Event Risk

Bearish USD Trade: Orders Contract 0.6% or Greater

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

EUR/USD Daily Chart

USD/CAD Daily Chart

XAU/USD Daily Chart

- Will watch the November high (1.2599) as EUR/USD holds above the monthly low (1.2356).

- Interim Resistance: 1.2610 (61.8% expansion) to 1.2620 (50% retracement)

- Interim Support: 1.2280 (100% expansion) to 1.2300 pivot

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| SEP 2014 |

10/28/2014 12:30 GMT | 0.5% | -1.3% | + 42 | + 27 |

September 2014 U.S. Durable Goods Orders

EURUSD M5: 56 pips price movement by USD - Durable Goods Orders news event:

Demand for U.S. Durable Goods slipped another 1.3% in September

following the record 18.3% contraction the month prior. Orders for

non-defense capital goods excluding aircraft, a proxy future business

investments, also fell 1.7% during the same period. The persistent

weakness in demand for large-ticket items may further dampen the outlook

for global growthamid the weakening outlook for Europe and China. The

greenback struggled to hold its ground following the worse-than-expected

print, with EUR/USD climbing above the 1.2750 handle, but there was

limited follow-through behind the market reaction as the pair closed at

1.2734.

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5: 37 pips price movement by USD - Durable Goods Orders news event

Experts: RobotiADXwining

Common points of best robots

What are the common points of those EAs which are at the top of the automated trading?

They are all very profitable, I know )

What else?

Cannot run MetaEditor

Hi,

I have MT5 from two brokers. One of them is Alpari. I was working with MetaEditor, after while I've closed it, then I've tried to open it but it wouldn't. I cannot run MetaEditor from MT5, from Program Files (I've tried Run As A Administrator). I've tried reinstall, but did not work. I've tried reinstall into different location, did not work. When I try open MetaEditor from MT5 by another broker - It works. If I run Windows 7 in Safemood Option - It Works. If I run it through Avast SandBox - It works.

I have no idea why it is not working. I don't get any error message etc. It just do nothing.

How to save/load EA 'input parameters' programming in MQL5?

Maybe you can hardcode parameters in an array of custom structure type. Then only use 1 parameter for index of your array to use.

I'm also interested by such a function ! Is it yet possible to do it without hardcoding parameters, but using a file ? Kinda ...

- You optimize

- Save the parameters

- On init the EA autoload params from the file.

EDIT : maybe file fileread, but concatenating line by line may take some times to be coded, anyone have such a function to share ?

How does CPU/RAM impact backtesting/optimization?

I'm soon about to buy a notebook that can cope with building and testing expert advisors.

Here goes my question - which part of hardware is more important in terms of backtesting and optimization? Is it CPU or RAM?

My favorite time frame:

- D1

- H4

- H1

- M30

- M15

- M5

- other

plot indicator/tool only if click on price panel

Very similar to one indicator available on NT support forum called : " dDrawABC " , here is the link http://www.ninjatrader.com/support/forum/local_links.php?catid=4&sort=N&pp=15&page=3

In the pic I attached on the first post I made some changes to it , but you get the Idea of the indicator.

Traders Joking

Traders Joking

But keep in mind, always when stretching the spine, contract the abdominal muscles to avoid injuries in the spine.

Scripts: Close All Open Orders

thank you for sharing with our friends )) use its full worth

Absolutely New Version of MetaTrader 5 for Android: New Design, Depth of Market, Tick Chart and Financial News (VIDEO)

Can it run EAs?

File : Open, read line by line, use what has been read, close

Solved. No extra path, just the terminal path set & the filename.

heeeeeeeeeeelp: How to save and load the control states of a dialog with IniFileSave() and IniFileLoad()

Hi, I just reviewed the UI related source code (for example, Dialog.mqh, WndContainer.mqh, Edit.mqh, etc.).

I thinke that you can not use "IniFileSave()" and "IniFileLoad()" to save/load the content of the edit box. These functions can only save/load the position and status of the dialog box (they are implemented in the Dialog.mqh, but the edit box control doesn't implement the save/load feature.)

So you need to write your own code the load/save the content in your application.

You may refer to the code below:

void CAppDialog::IniFileSave(void) { string filename=IniFileName()+IniFileExt(); int handle=FileOpen(filename,FILE_WRITE|FILE_BIN|FILE_ANSI); //--- if(handle!=INVALID_HANDLE) { Save(handle); FileClose(handle); } }

bool CDialog::Save(const int file_handle) { //--- check if(file_handle==INVALID_HANDLE) return(false); //--- save FileWriteStruct(file_handle,m_norm_rect); FileWriteInteger(file_handle,m_min_rect.left); FileWriteInteger(file_handle,m_min_rect.top); FileWriteInteger(file_handle,m_minimized); //--- result return(CWndContainer::Save(file_handle)); }

bool CWndContainer::Save(const int file_handle) { bool result=true; //--- loop by elements of group int total=m_controls.Total(); for(int i=0;i<total;i++) { CWnd *control=Control(i); //--- check of pointer if(control==NULL) continue; result&=control.Save(file_handle); } //--- result return(result);

class CObject { .............................. //--- methods for working with files virtual bool Save(const int file_handle) { return(true); } ...................................... };

The CEdit class is inherited from CObject (indirectly) but the "Save" method is not overridden to provide more implementations.